- Trading Sardines Linda Raschke Pdf

- Trading Sardines Linda Raschke Pdf Download

- Linda Bradford Raschke Trading Sardines Pdf

- Trading Sardines Linda Raschke Pdf

Linda began her professional trading career in 1981 as a market maker in options. She became a registered Commodity Trading Advisor in 1992. She worked as a principal trader for several funds. In 2002 she started her own hedge fund, which was ranked 17th out of 4500 for best 5-year performance by BarclaysHedge.

Jack Schwager recognised her great talent in his famous Market Wizards series. Since 2015 Linda continues to trade daily for her own account. In the world of professional trading and money management, Linda stands out from the crowd for three factors: performance, longevity and consistency.

Most frequently when talking about trading, we focus on its positive aspects. Linda takes a different perspective in this interview sharing with us market lessons while highlighting the tension between luck, risk, and passion.

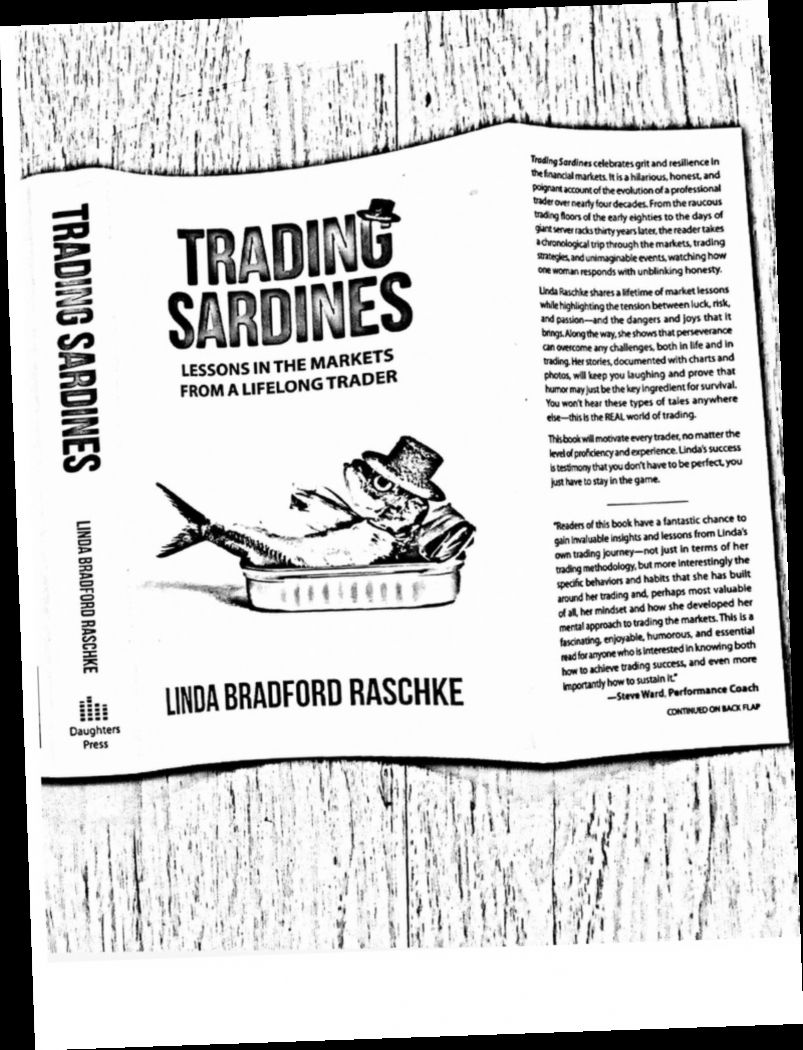

You can buy the book here. Too lazy to write that blog post about Linda Raschke's autobiography, 'Trading Sardines,' I'll just post excerpts I liked in this thread: — C. Maoxian (@maoxian) July 11, 2019. Most underestimate the time and energy required to achieve consistent profitability.' Maoxian (@maoxian) July 11. Market Wizard Linda Raschke’s 12 Technical Trading Rules. Buy the first pullback after a new high. Sell the first rally after a new low. Afternoon strength or weakness should have follow through the next day. The best trading reversals occur in the morning, not the afternoon. The larger the market gaps, the greater the odds of continuation. Sep 20, 2013 Linda Bradford Raschke – 50 Time Tested Classic Stock Trading Rules. Plan your trades. Trade your plan. Keep records of your trading results. Keep a positive attitude, no matter how much you lose. Don’t take the market home. Continually set higher trading goals. Successful traders buy into bad news and sell into good news. Raschke, Linda - Trading Sardines.pdf r2r38yn9qn26. ‘ iddng Sardines celebrates grit and resilience In nancial markets. It is a hilarious, h o n e s t a n d P^Hant account.

To me, it’s an extraordinary interview with an extraordinary person summarising her great book titled “Trading Sardines“. It is indeed a 21st-century version of “Reminiscences of a Stock Operator“! Linda although being so successful as a professional trader, openly admits how repeatedly got her ass kicked by the markets.

It sounds so attractive when we can mention how you feel making one million in one single day. Linda, however, puts an accent on being on the wrong side of outliers so many times that it is well beyond the random. Rare events are happening more often than we think, especially if you are on the markets so long as Linda.

NOTE I had the honour to have Linda already on my podcast in the first episode, and I highly recommend it everyone who has not yet listened to it.

In this episode

- Linda’s latest book “Trading Sardines” as a 21st-century version of “Reminiscences of a Stock Operator“

- Why it’s never the news itself but always the market’s reaction to the news that is most telling?

- Why rare events/black swans are happening more often than we think?

- Why there’s such a difference between theory/academic world and reality?

- What is Linda’s average yearly rate of return for her career?

- Many stories from the past when Linda was going through extreme events while trading

Some useful links

- Recommended literature

- Trading Sardines, Lessons in the Markets from a Lifelong Trader, Daughters Press, Linda Bradford Raschke, 2018

- Street Smarts: High Probability Short-Term Trading Strategies, M. Gordon Publishing Group, Linda Bradford Raschke & Larry Connors, 1996

- Charting the Stock Market: The Wyckoff Method, Technical Analysis, Jack K. Hutson, 1991

- Stock Market Technique No. 1 & No. 2, Fraser Publishing Co., Richard D. Wyckoff, 1984

- Studies in Tape Reading, Martino Fine Books, Richard D. Wyckoff (Pen Name: Rollo Tape), 2011

- Technical Analysis and Stock Market Profits, FT Press; 1st edition, Richard Schabacker, 1997

- The Taylor Trading Technique, Seven Star Publishing; Reprint edition, George Douglas Taylor, 2016

- Wall Street Ventures & Adventures Thru 40 Years2 edition, Richard D. Wyckoff, 1985

- The Secrets of Turf Handicapping, Landau Book Co., Robert Bacon, 1965

- People mentioned in this episode

How to become a successful trader? 😉

Trading Sardines Linda Raschke Pdf

Comments are welcome!

I encourage you to comment on this episode. You can do this by pressing the button below. Please also visit my profile on Twitter. 🙂

I really count on your voice! Thank you! 🙂

Do you like what you see?

If you want me to inform you next time I have a new article/podcast episode, sign up below for my newsletter!

There was an error submitting your subscription. Please try again.

Thanks for joining! Check your email to complete your subscription

Previous Post: 🔊 STS 009 – Andreas Clenow: quant approach to trend following and equity momentum strategies

Next Post: 🔊 STS 011 – Gary Antonacci: combining relative strength price momentum with absolute momentum

Trading Sardines Linda Raschke Pdf Download

One of the big lessons Ben Graham taught in The Intelligent Investor was the difference between investing and speculating. He knew how easily the market distracts investors from their original purpose.

Most investors start off with the idea of compounding their money over a long period of time. But some of them are bound to get sidetracked.

Before they know it, some investors start feeding their impulses triggered by Mr. Market’s manic moods. Their emotions take over. Stocks become pieces of paper, rather than portions of a business, to trade in and out of. Price moves become the only factor behind their decisions.

Seth Klarman used a funny analogy in his book Margin of Safety to describe this mistake. He tells the story of special sardines.

There is an old story about the market craze in sardine trading when the sardines disappeared from their traditional waters in Monterey, California. The commodity traders bid them up and the price of a can of sardines soared. One day a buyer decided to treat himself to an expensive meal and actually opened a can and started eating. He immediately became ill and told the seller the sardines were no good. The seller said, “You don’t understand. These are not eating sardines, they are trading sardines.”

Like sardine traders, many financial market participants are attracted to speculation, never bothering to taste the sardines they are trading. Speculation offers the prospect of instant gratification; why get rich slowly if you can get rich quickly? Moreover, speculation involves going along with the crowd, not against it. There is comfort in consensus; those in the majority gain confidence from their very number.

Today many financial-market participants, knowingly or unknowingly, have become speculators. They may not even realize that they are playing a “greater-fool game,” buying overvalued securities and expecting — hoping — to find someone, a greater fool, to buy from them at a still higher price.

There is great allure to treating stocks as pieces of paper that you trade. Viewing stocks this way requires neither rigorous analysis nor knowledge of the underlying businesses. Moreover, trading in and of itself can be exciting and, as long as the market is rising, lucrative. But essentially it is speculating, not investing. You may find a buyer at a higher price — a greater fool — or you may not, in which case you yourself are the greater fool.

Linda Bradford Raschke Trading Sardines Pdf

It’s a fitting reminder of the risk that comes with ignoring value, succumbing to instant gratification, and attempting to pull off decades of compounding in a matter of months. Trying to get rich quickly in the stock market is more likely to leave you poorer…and with a horrible taste in your mouth.

Source:

Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor

Last Call

Trading Sardines Linda Raschke Pdf

- The Price of Risk! – Musings on Markets

- Investing in a Bubble – Verdad

- Why Bubbles Are Good For Innovation – A Wealth of Common Sense

- Pitfalls of the Inflation Narrative – Klement on Investing

- How to Be Lucky – Psyche

- Why You Should Practice Failure – Farnam Street

- “Hard Times Tokens” Were Not One Cent – Daily JSTOR

- The Secret Letters of History’s First-Known Businesswomen – BBC