Printing & Mailing Upload:

Once you have imported your records, click on Via the Service Bureau under the 2nd step, 'Printing & Mailing', located to the left of your screen. Click on the Printing & Mailing or E-Delivery Upload button located at the top of your screen to initiate a helpful Wizard that will guide you through the upload process. On the last screen, click on Finish to print your Control Totals report. Review an sign your report. Back in your software, highlight your pending upload, and click on the Complete Pending Upload option located at the bottom of the screen to send your upload to the Service Bureau. Fax/email your Control Totals and cover sheet to sb@1099pro.com to confirm that you are ready for the Service Bureau to print and mail your records!Electronic Filing Upload:

When you are ready to upload your records to the IRS or SSA, click on Electronic Filing under the 3rd step, 'Filing My Forms', located to the left of your screen. Click on the Filing with the IRS Upload button located at the top of your screen to initiate a helpful Wizard that will guide you through the upload process. On the last screen, click on Finish to print your Control Totals report. Review an sign your report. Back in your software, highlight your pending upload, and click on the Complete Pending Upload option located at the bottom of the screen to send your upload to the Service Bureau. Fax/email your Control Totals and cover sheet to sb@1099pro.com to confirm that you are ready for the Service Bureau to electronically file your records!Bulk TIN Upload:

To run a Bulk TIN match using the Service Bureau, click on Via the Service Bureau under the 2nd step, 'Printing & Mailing', located to the left of your screen. Click on the Bulk TIN Matching Upload button located at the top of your screen to initiate a helpful Wizard that will guide you through the upload process. On the last screen, click on Finish to print your Control Totals report. Review an sign your report. Back in your software, highlight your pending upload, and click on the Complete Pending Upload option located at the bottom of the screen to send your upload to the Service Bureau. Fax/email your Control Totals and cover sheet to sb@1099pro.com to confirm that you are ready for the Service Bureau to check your TINs!

ComplyRight 2020 LaserLink XL Software for W-2, 1099, and ACA Tax Forms (1203450) 3.5 out of 5 stars.

Irs W2 Software

W2 Software 2020

If you have additional questions, email support@1099pro.com or call us at 888-776-1099.

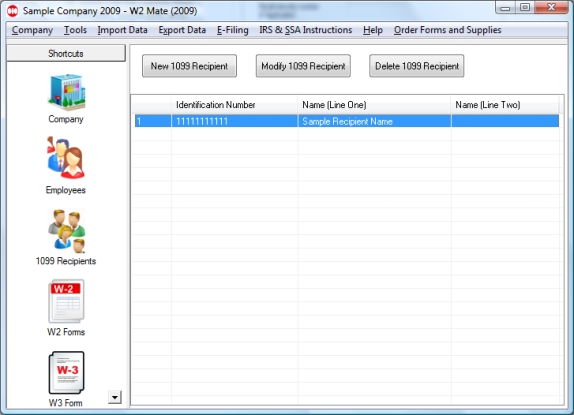

W2 Mate is the ONLY software that generates secure PDF W2's (Employee Copies of W2 Form in PDF Format) and secure PDF 1099's (Recipient Copies of 1099 NEC / 1099 MISC form in PDF format). The resulting PDF files can then be electronically sent to consenting employees and/or recipients instead of paper copies. Download Form W-2 & 1099 printing software for free, with no obligation and no risk. EzW2 software can prepare tax forms W2, W3, 1099 NEC and 1096. It can print SSA-approved laser substitute W-2 Copy A and W-3 on white paper. W2 SOFTWARE, W2 PRINTING SOFTWARE, 2020 / 2019 W2 PREPARATION SOFTWARE. Camel crusher vst. Available in these Right Networks packages. Jun 19, 2013 By National Software. Forms W-2 provide information to your employees, the SSA, the IRS, and state and local governments. Employers must file Form W-2 for wages paid to each employee from whom: 1.